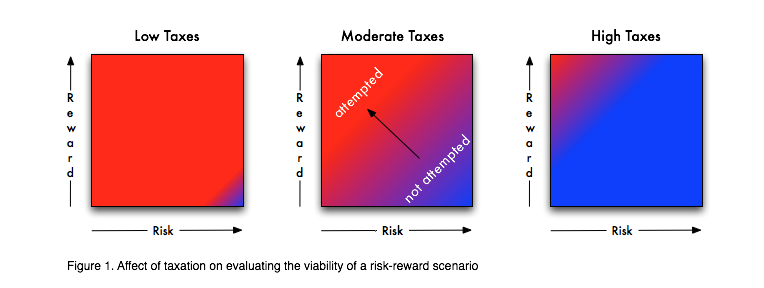

Bill O’Reilly is disingenuous when he says high taxes might compel him to quit his lucrative job. Although there is a level where taxes can have that effect (why engage in challenging work if taxes limit your income to that of someone flipping burgers), we are nowhere near it. However, taxes and regulation do result in a net decline in businesses and jobs albeit by a different mechanism than “quitting”. The mechanism is attrition. Businesses fail due to normal changing market demands, bad luck, poor leadership or other reasons. New businesses take their place, however as taxes and regulations increase, the rate of business replacement declines. Why? Some business ideas are high risk and some are low risk and both types may have a high or low reward. A graphical metaphor works best here (Figure 1).

Imagine a square, the left side indicates increasing reward (bottom to top) and the bottom indicates increasing risk (left to right). As taxes and regulations increase it makes those endeavors in the lower right corner (high risk-low reward) less appealing because of reward diminishment (taxes and regulation costs consume the reward). As taxes and regulation climb we continue to move across the square from lower right to upper left along a diagonal front: everything to the right of the diagonal will not be attempted, everything to the left will be attempted. As taxes and regulations continue their march upward that diagonal shifts further and further to the left until the only thing remaining is extremely low risk-high reward ideas.

Why should taxes and regulations yield such a result? Let’s say you need an income of $50,000/year to live on and you start a business with a 2:1 return on invested capital. That means if you invest $25k you’ll reap a profit of $50k. If you are taxed at 50% then you will be left with only $25k. So you would steer clear of investing in such a business since the reward is insufficient for your needs. You would only invest in a business that had a much higher return on capital, at least 4:1. The aggregate net result is that a lot of otherwise profitable businesses simply don’t get started or funded because their potential for gain after taxes simply isn’t worth the risk relative to other ways the money could be spent. And if no potential projects exist with a sufficiently low risk and high reward then investors simply sit on their cash until one does come along.

Some hold the condescending view that if a business can’t turn a profit after taxes then it just shouldn’t exist. The presumption is that if people aren’t willing to pay a price with large embedded taxes and regulatory costs then they have no right to such a good or service. The fatal flaw in this reasoning is an assumption that it is impossible for there to exist a level of taxation or regulatory burden that is unjustifiable. This mindset leads to business destruction. When a business is caught between government mandated costs and the unwillingness of the public to pay prices that reflect those costs then that business is squeezed out of existence.

If ten businesses fail each year and only seven new ones start there will be a net decline in businesses. Absent high taxes and regulations there would have be another five that would have opened. We don’t see what wasn’t created so there is no obvious cause and effect at first glance. Analyzing the problem from an economic incentives framework quickly reveals the source of the problem. Regulations and taxes are like a flood – they drown everything in its path. To restore prosperity we must allow good ideas to flourish by removing the artificial shackles that incentivize only low risk-high reward ventures.