Last week’s article touched on seen benefits and unseen harms wrought by political intervention into people’s lives. This week we pivot to a somewhat new corollary of that principle, that of imagined harm. This is harm that can’t exist but because of a fundamental ignorance one has an expectation that it will occur. Ignorance of economics leads to a broad range of bad predictions and decisions and even businessmen (e.g. Donald Trump, Warren Buffet, etc) are not immune to such ignorance. Despite Trump’s repeated protestations that “we” (America) are “losing” because of the presence of trade deficits with some countries (notably Mexico and China) there is simply no cause for concern. The current trade deficit between the US and Mexico is $58 billion. That means that Americans purchased $294 billion in goods from Mexico but Mexicans purchased “only” 236 billion in US goods. In Trump’s mind (and many others) this constitutes a loss. Well if that is so I guess I had better stop buying my groceries from Publix – my family’s trade deficit with Publix is thousands of dollars every year! Yes, I would be much better off if I grew all my own food, than my trade deficit with Publix would be zero. Do you see how ridiculous this sounds now? So to solve a trade deficit Americans should pay even more for the goods they want? This is supposed to somehow compel the Mexican government to coerce its citizens into buying more US goods? How can any government make its people buy more from a particular country? Countries are not monolithic entities; they are composed of individuals.

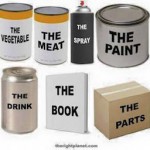

Trade is not a zero sum game where one side “wins” and the other side “loses”. Both sides gain or profit from any trade in the sense that if either party did not value the thing they got more than the thing they gave up they would not have engaged in the trade. Trump and his ilk view trade like a game of Monopoly because they fall for the fallacy of anthropomorphizing countries into single actors and then distill all trade down to a single good: money. So in his mind the US gave Mexico $294 and Mexico gave the US $236 – as though they were just swapping currency and nothing else. Yes, that would be a loss, but that is not at all what is going on. It is an absurd distillation of the transactions of millions of individual actors into a meaningless aggregate. To get a clearer picture of what is going we need to disaggregate these numbers. Let’s imagine that Joseph buys $10 worth of goods from José. Joseph now has a $10 item and José has a $10 bill. Who lost here? No one. Trump would view this as a $10 trade deficit. But a deficit implies some sort of debt obligation, that something is owed, but nothing is owed, both sides swapped value for value. Now imagine that José buys $7 worth of goods from Joseph. Joseph now has $3 in goods and $7 cash, or $10 of value. José now has $3 in cash and $7 in goods, again, $10 in value.

Indeed all trade follows the rules of double entry accounting. Mexico’s cash account goes up while their goods account goes down: in balance. The US’s goods account goes up while their cash account goes down: in balance. Claiming a trade deficit exists is the equivalent of looking at only one side of a standard accounting balance sheet and claiming it is not balanced because one refuses to look at the other side of the sheet.

To the extent that jobs and industry are moving out of the US and that this harms in the short term those that lose their jobs perhaps it would be more appropriate to not lay blame at the feet of those business moving away but rather ask the origin of the incentives they are responding to (regulations, unionization, taxes anyone?)